PROFILE

- Mandrel type products include air hose, food hose, water hose, sand blast hose, automobile hose, petroleum oil hose, protective cover hose, general wash down hose.

- Extrusion type products include air hose, water hose, welding hose, fire reel hose, automobile hose, multipurpose hose, petroleum hose and general wash down hose.

- The company exported approximately 97% of its rubber hose to Middle East, Europe, US, Canada, Australia, New Zealand, Asia, Africa and South America.

| Geographical

Segment |

| Year/Percentage |

2015 |

Percentage |

2014 |

Percentage |

2013 |

Percentage |

| Malaysia |

14,134 |

8.94% |

14,148 |

9.67% |

12,007 |

9.13% |

| Middle East |

21,833 |

13.81% |

20,991 |

14.34% |

18,770 |

14.27% |

| Europe |

22,718 |

14.37% |

21,512 |

14.70% |

19,155 |

14.56% |

| USA/Canada |

32,049 |

20.27% |

28,159 |

19.24% |

18,440 |

14.02% |

| Australia/New Zealand |

17,742 |

11.22% |

14,304 |

9.77% |

12,564 |

9.55% |

| Asia |

34,316 |

21.70% |

30,825 |

21.06% |

29,404 |

22.36% |

| South America |

11,135 |

7.04% |

12,825 |

8.76% |

17,998 |

13.68% |

| Africa |

4,185 |

2.65% |

3,599 |

2.46% |

3,192 |

2.43% |

|

158,112 |

100.00% |

146,363 |

100.00% |

131,530 |

100.00% |

STRENGTH

- Net cash company with 40 million cash in bank.

- Selling rubber hose to 6 major application markets - air and water, welding and gas, oil and fuel, automobile, ship building, food and beverage.

- 50% of net profit dividend policy (high dividend yield company)

- Declining cost of latex

- 90% of its sales are from export

- Benefit from the introduction of GST where the company used to pay 10% service tax where the GST system has reduced the tax down to 6%

- Strong ROE @ 42%

- Improve in cost efficiency where profit margin of the company increased.

- The company has consistently grow and improve over the 5 years.

WEAKNESS

- High PE of 22 where the price might reflect its value?

- Profit margin and sales might drop when RM strengthen and raw materials cost increase.

FUTURE PROSPECT

- Constructing a 3rd factory production line which will increase the production from 35000 tons to 45000 tons.

- Rubber compounding machine will be install in the new production factory where WellCal can enjoy a better margin. (this segment is currently outsourced)

PROFILE

- Manufacturing division - cooking oil, margarine and shortening.

- Packaging division - aerosol can division and corrugated carton division.

- Palm oil refinery and mill division

- Trading division - distributors for Campbell, Old Town products, Kizz products, Red Bull, Helang oil, spritzer and cactus mineral water, SunLico oil, Vesawit oil,

- Plantation division - oil palm estate in Tapah and Gopeng, tea plantation in Nalapak, Sabah.

- Tourism related services

STRENGTH

- Securing the distributorship for red bull where red bull has dominate 55% of the energy drink market in malaysia.

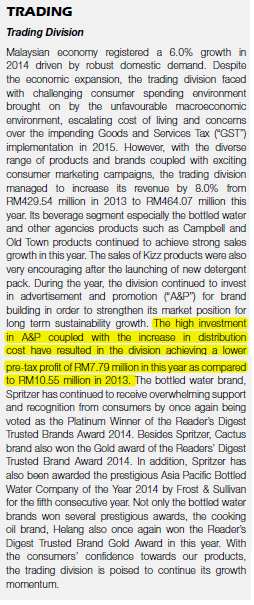

- the bottled water and other agencies products such as Campbell and Old Town products continued to achieve strong sales growth in this year. The sales of Kizz products were also very encouraging after the launching of new detergent pack.

WEAKNESS

- Escalating cost of living and implementation of GST

- Increase in cost of production lead to a lower porfit margin and PAT.

- Low profit margin and drop in profit margin for every division

- ROE is less than 10

- Not benefiting from the USD trend as more than 90% of its trades are denominated in RM.

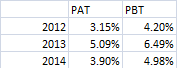

- Performance for each division :

- Securing the distributorship of red bull energy drink (5 years distributiorship starting October)

- Relocating its machineries and workforce to a larger factory in Vietnam to expand its production capacity and warehouse facility to maximize its operational efficiency for the aerosol can division. Low aluminium prices may lead to lower production cost for aerosol can.

PROFILE

- Fastening products (86.6%) - Manufacturing and trading of screws, nuts, bolts and other fastening products.

- Wire products (16.4%) - Manufacturing of precision galvanized wire, annealing wire, bright wire, hard drawn wire, PVC wire, bent round bar and grill mesh.

- Founded in 1989, Chin Well is today one of the world’s largest manufacturers and suppliers of high-quality carbon steel fasteners (i.e. screws, nuts and bolts). Through production facilities in Malaysia and Vietnam, Chin Well manufactures and supplies fasteners global fasteners that are primarily utilized in highway guard rails, power transmission towers, furniture and other applications. In addition to serving the requirements of the domestic market, Chin Well established an international customer base from South East Asia (SEA) to Europe and the Middle-East to date.

STRENGTH

- Dividend policy of 40% which translates into 2-3% dividend yield a year.

- The Group successfully acquired the balance of 40% interest in Chin Well Fasteners (Vietnam) Co. Ltd (CW Vietnam) by purchasing the entire share capital of Asia Angel Holdings Limited (Asia Angel), which owns the 40% stake. This move enables the Group to fully-consolidate the earnings from the high-growth CW Vietnam, which serves the Do-It-Yourself (DIY) fastener segment and enjoy a favorable product mix (better profit margin)

- The Group made a strategic decision to venture into the production of downstream wire products so as to expand its product range and target new local and foreign customers.

- Net cash company with 2 millions of cash after paying off all its borrowing.

- The European Union (EU) had, in March 2015, renewed tariffs on anti-dumping for the China-made fasteners for another five-year period until 27 March 2020. The duty imposed was as high as 74.1% on imports of steel fasteners originating from China, and was extended to Malaysia-based manufacturers except for nine exempted companies. We are pleased that Chin Well is amongst the nine Malaysian manufacturers exempted from the duty which will undoubtedly enhance our competitive edge.

- The implementation of Goods and Services Tax (GST) in April 2015 proved to be beneficial to us, as the 6% GST was lower than the previous sales and service tax of 10%. The more competitive pricing, together with timely delivery, places Chin Well in a favourable position to capture more market share in the domestic market.

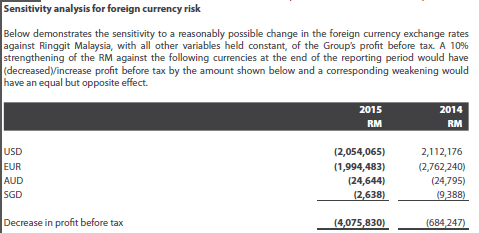

- 51% of its trade receivable are USD dominated while only 13% of its trade payable are dominated by USD.

- Improve in sales from both fastening and wire products.

- Riding the current USD trend where the strengthening of USD, EUR, AUD and SGD is favorable for the company.

- The company account for 80 - 90% of fastener market in Malaysia, therefore, it wont affects the company much during the world economic recession.

- Benefit from its DIY fastener division during the economic recession as the Europe is experiencing an economic recession and this will lead more household to fix their house themselves which translates to more sales order for ChinWel.

- Benefiting from TPPA, export tax rate from Vietnam to US is currently at 8%, after the implementation of TPPA, the company will be in a more competitive position compared to the china competitors. On top of that, US has an even bigger market than Europe.

- Chinwel accounts for 3% sales of the world fastening products.

- Raw materials for fasteners include stainless steel, aluminium, and copper. Prices of these raw materials have been declining, and touched a base of five-year low. This explains the improve in profit margin of the company where the profit margin before tax stands at 11% for both 2014 and 2015 while 7% in 2013.

WEAKNESS

- Monthly production of 6500 tons from both its malaysia and vietnam factory however in malaysia, the production has hitting its limit as there is a shortage of labor resources in malaysia.

- Higher operating cost for chinwel compared to its competitors in china due to a leaner rules and regulation in china. For example, monthly water treatment expenses for chinwel would cost as much as 400k. However, china is currently implementing a stricter law to protect its environment therefore, the company believes that they can keep up its competitiveness with china company in 5 years time.

- Economy in Euro zone will affect the revenue of CHINWEL as 56% of its revenue are from Europe, 22% from Malaysia and remaining from other countries.

- Depreciation of Ringgit Malaysia to Vietnam Dong might increase CHINWEL expenses as they have factory operation in Vietnam and 54% of its trade payables are in Vietname Dong.

FUTURE PROSPECT

- Expand our customer base in DIY fastener sector, building upon our presence and track record thus far. We are in talks with various DIY retailers to increase our distribution network, particularly in Europe.

- Expand our wire product clientele for downstream products of high-security fencing and gabion. We have already secured orders from Malaysia, India, Middle East and Canada, and are targeting steady orders from Middle East and Canada.